United Kingdom Sotheby’s International Realty 2025 H1 Performance: A Positive Trajectory

With H1 drawing to a close, data from UK Sotheby’s International Realty shows that the company is outperforming market expectations in both sales and lettings. This commendable performance builds momentum for continued growth in H2, reinforcing the brokerage's founding mission — to disrupt the industry and redefine the standards of excellence.

London’s Super-Prime Residential Market: Reeling and Recovering

London's prime property market has been reeling from shifting economic policies and government transitions in major countries, including the United States. However, these disruptions have not been as severe as expected, and our numbers reveal renewed confidence in the super-prime market and its offerings.

The main shocks to the housing market came from the abolition of the generous non-dom provisions, whereby non-domiciled residents in Britain were not taxed on their wealth abroad. At present, as of April 2025, non-dom citizens are liable to pay UK tax on all their worldwide income and gains. Notwithstanding the concessions employed to ease this transition, the policy shift was expected to further destabilise an already volatile market. Further, the increased stamp duty rates – with an additional 2% surcharge for foreign buyers – amplified the overall tax burden on the market’s key demographic.

Research from leading market analysts shows transaction values have plummeted in London's most sought-after neighbourhoods, including Mayfair, Chelsea, Belgravia, Westminster, Kensington, and Hampstead. The market has stagnated as sellers resist price cuts while buyers hesitate to commit. Meanwhile, LonRes data shows that reduced luxury rental supply has driven up rental prices. Compounding these challenges, over 10,800 millionaires have left London, with projections suggesting thousands more will follow suit.

The market, however, has been absorbing this turbulence admirably. This, in large part, can be attributed to the enduring global appeal of London thanks to its financial infrastructure, cultural cachet, educational excellence, and world-class lifestyle amenities. Furthermore, market data and our internal analytics reveal that an influx of high-net-worth individuals has plugged the departures.

Our Market Assessment

UK Sotheby’s International Realty Continues to Dominate the Market

Following a year in which the brokerage achieved £1.2B in total sales, the firm has sustained its momentum, securing nearly £600M in sales during the first half of 2025, demonstrating resilience in a challenging market environment. Over 55 of these transactions were executed in Prime Central London, representing £400M in value. July proved particularly high octane, with over 32 sales completed across Prime Central London and South West London, as properties progressed swiftly from instruction to exchange within weeks of marketing.

The UK- A Safe Haven For International Capital

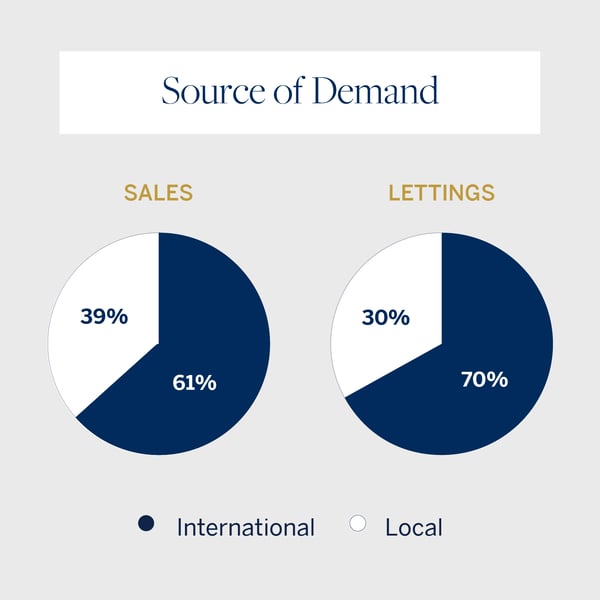

While UK nationals form the largest group of buyers and tenants, international clients represent a substantial portion of our portfolio. This international wealth migration, especially against a backdrop of policy changes and economic upheaval, reinforces the market’s steadfast faith in the nation’s lifestyle and investment offering.

London – A Place To Put Down Roots

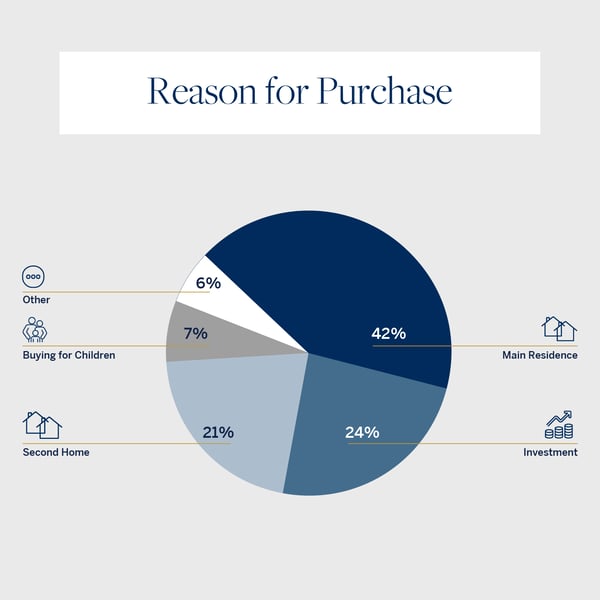

About 42% of UK Sotheby’s International Realty’s properties were purchased as permanent residences, followed by 24% being bought as investment assets. Furthermore, nearly half of the firm’s tenants are relocating to London from abroad. This demonstrates both genuine residential demand and sustained investor confidence in London's long-term prospects.

Fortifying the nation’s appeal is the fact that the brokerage received 7,611 enquiries valued at £103B.

A Buoyant Rental Market

London and the broader UK market are experiencing a particularly flourishing rental sector, evidenced by our in-house data and industry reports. During the first quarter of 2025, UK Sotheby’s International Realty facilitated lettings worth £26.9M.

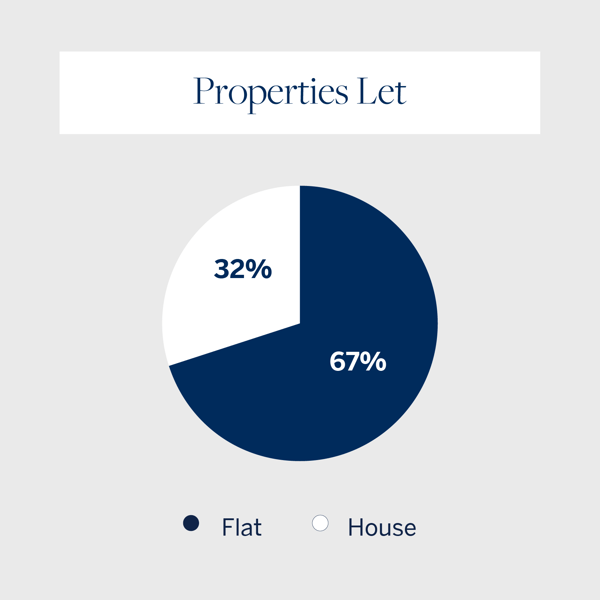

The Growing Appeal of Flats

The vast majority of properties let and sold by UK Sotheby’s International Realty were flats, reflecting the residential preferences of international high-net-worth individuals. This can be attributed to their preference for expansive lateral accommodation and the exclusive amenities that are on offer with super-prime flats: round-the-clock concierge, security, and communal leisure facilities.

Final Thoughts

Against a backdrop of policy changes and political uncertainty that many believed would rattle the market, London's prime property sector has demonstrated remarkable resilience.

This tenacity, however, is not unprecedented – the UK has a history of weathering policy shifts without losing momentum. For instance, while a 5% stamp duty hike was introduced on homes worth over £1M in 2010, the market still saw a 54% increase in £1 M-plus home sales compared to 2009.

At UK Sotheby’s International Realty, this resilience translates into tangible results, reflecting our prominence in the highly competitive luxury property sector as well as the enduring appeal of London’s real estate. The sheer volume of transactions and enquiries, in spite of policy implementations that were expected to sour the appetite of international investors, proves that our clients are not merely riding out temporary turbulence. They are actively investing in what they perceive as London's enduring value proposition.

This confidence stems from a combination of factors unique to London. It is a magnet for global capital and a hub of technology, innovation, and the arts, where creative and commercial talent converge. The city is defined by its rich cultural heritage and a liberal, welcoming spirit, reflected in its extraordinary mosaic of nationalities. Additionally, few cities cater to such a wide spectrum of lifestyle and stylistic sensibilities, with London offering a plethora of neighbourhoods — some with a history spanning centuries, others strikingly contemporary; some by the Thames, others tucked away around quiet, manicured garden squares.

While headlines focus on departures, our data depicts a more nuanced picture — one of strategic investment, residential commitment, and steadfast demand across both sales and lettings.

The numbers reflect more than just the market’s strength. They evince the trust placed in UK Sotheby’s International Realty to deliver results, particularly in uncertain times. As we move through 2025, that foundation positions us to build on this trust and achieve new heights.